From Interconnecting Data Centers to Consolidation and Convergence, Find Out What’s Ahead for the Broadband Industry

Bob Whitman

Published: December 11, 2025

The broadband industry has undergone rapid transformation in recent years and continues to evolve as both consumer connectivity expectations and AI-driven applications reshape network demands. With the addition of federal funding for broadband projects starting to flow, these forces are pushing carriers to quickly adapt, both in terms of how they operate and what they offer customers. As we move into 2026, I expect this evolution to reach new heights, with operators seeking alternative ways to support unprecedented traffic growth.

As we close out the year, here are three key trends I’ll be watching closely as the industry prepares for another year of accelerated change.

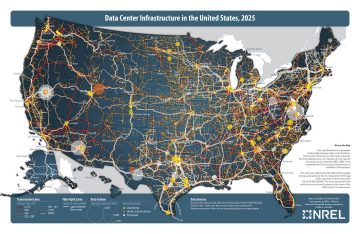

1. Carriers play a crucial role in data center interconnects

From AI inference and training to edge computing and automation, data-intensive applications are placing new pressure on data centers and the networks that interconnect them. Hyperscalers have experienced exponential growth over the last few years, accounting for 44% of the worldwide capacity of all data centers, according to Synergy Research Group. And the industry expects more than 100 new hyperscale data centers to be built annually to keep up. Because of this expansion, carriers will increasingly play a central role in building and operating critical interconnects.